Investment objective

The investment objective is to generate superior returns for Unit holders by investing in global markets, with a focus on reducing risk and preserving capital.

More information can be found in the Information Memorandum located at the Fund website.

Applications available here.

Investment Strategy

The Defender Global Fund (Fund) provides investors with exposure to global markets through a long and short strategy

The Fund starts with the Managers global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combines this with a bottom-up investment decision criteria.

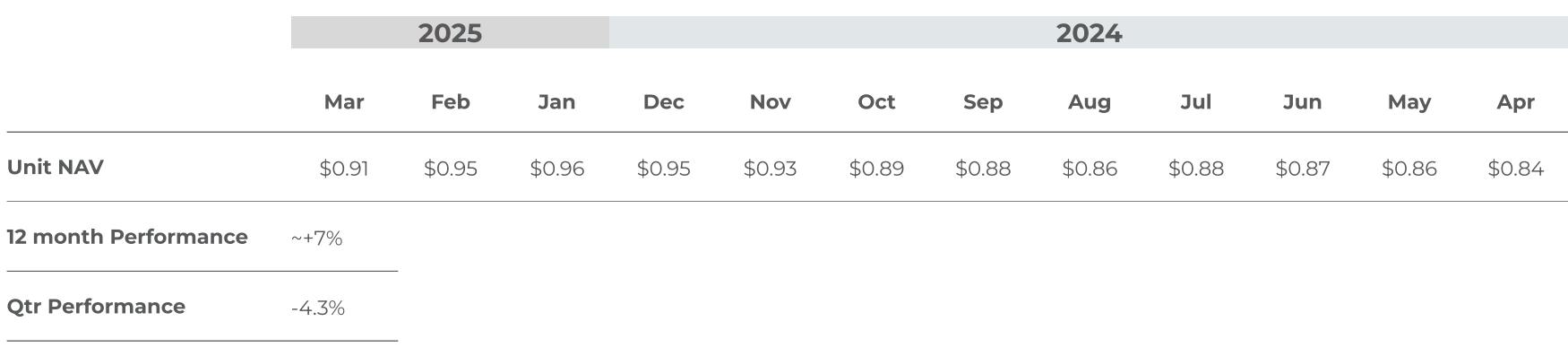

Performance Summary

Commentary

The Defender Global Fund returned -4.3% in Q1 CY2025

The Defender Global Fund (“DGF”) has a very positive long term view on AI and AI beneficiaries. In the first quarter of 2025 we saw an explosion of new use-cases and applications for AI, as well as continued heavy investment into data centres and GPU compute by the major hyperscalers (AMZN, GOOG, META, MSFT and NVDA) to keep up with rapidly growing customer demand. In quarter four of 2024 DGF took profits on its positions in AMZN, GOOG, NVDA on the belief that the AI trade had run too far too quickly. We began buying back these positions during the first quarter of 2025 into the US tariff induced sell-off in equity markets. As an example of the emerging use cases, increased efficiency and functionality for AI, the bulk of this Q1 newsletter has been written using AI tools. This was completed in a fraction of the time it typically takes to write previous newsletters – our favourite publicly available large language model is Gemini 2.0 (a GOOG product). The first quarter of 2025 was marked by increased volatility and uncertainty, driven by a combination of factors. Global economic growth showed signs of slowing, with some

regions facing the possibility of contraction.

Equity markets experienced sharp swings. The S&P 500 declined, reversing some gains from the previous years. Mid and small-cap companies were particularly affected. International equities performed better, supported by a weaker US dollar. Fixed income markets were generally positive, driven by expectations of future interest rate cuts. Corporate credit spreads widened due to concerns about slowing economic growth. Key themes included rising global tensions, shifting monetary policies among central banks, and the impact of trade tariffs, notably those implemented by the US. The technology sector faced headwinds, while other sectors like energy and healthcare performed better. Gold prices surged as investors sought safe-haven assets. Overall, the first quarter of 2025 presented a complex and challenging environment for investors, requiring careful navigation of economic uncertainties and geopolitical risks. DGF tracks multiple macroeconomic metrics to gauge the current and future direction of financial markets. In the first quarter of 2025, the US 10yr bond yield moved from 4.57% toN 4.18%, the USD (measured by the Wall Street Journal Dollar Index) moved from $103.18 to $99.69, with the quantum of movement on both metrics in such a short space of time

causing disruption to financial markets.

GOOG Q1CY25 Earnings Result

At their recent result, GOOG revealed strong growth across multiple business segments, a very strong outcome providing some ballast against the view that their Search business was facing increased competition form OpenAI’s ChatGPT and Perplexity AI: Alphabet, Google’s parent company, reported strong Q1 2025 results. Key highlights include

- Revenue: $90.2 billion, a 12% year-over-year increase(14% in constant currency).

- Earnings per share: $2.81, significantly exceedingexpectations

- Net income: $34.54 billion, up 46% year-over-year.

(Note: This includes an $8 billion unrealized gain on

non-marketable equity securities – predominately

SpaceX. - Google Search & Other: Google Search & Otherrevenue grew by 9.8%

- Google Cloud: Google Cloud revenue increased by 28% year-over-year to $12.3 billion

- The company announced a 5% increase in its quarterly dividend

- YouTube: YouTube’s advertising revenue reached $8.93 billion in Q1 2025, a 10.3% year-over-year increase. YouTube Premium and YouTube TV subscriptions contributed to overall subscription growth, which reached 270 million

- Gemini: Google rolled out Gemini 2.5, its most intelligent AI model, which is recognized as a leading model in the industry

- Waymo: Waymo is now safely serving over a quarter of a million paid passenger trips each week, up 5x from a year ago.

Overall, Alphabet’s Q1CY25 earnings demonstrated robust growth across key segments, driven by Google Search, Cloud, and YouTube. The company’s AI initiatives, particularly with Gemini, are central to its growth strategy, and Waymo’s growth is also notable – one wouldB expect this business to be richly priced as a result, but GOOG trades at below 18x forward earnings and low

teens EV/EBITDA, too low for such a high quality business.

AMZN Q1CY25 Earnings Result

The other notable result was AMZN’s Q1CY25 earningsresult, which highlighted strong growth across thecompany with particularly impressive growth in AWS(Cloud and AI), which is now at a $117 billion annualized run rate:

- Operating income: $18.4 billion, a 20.2% year-over-year increase

- Revenue: $155.7 billion, an 8.6% year-over-year increase

- Net income: $17.1 billion, or $1.59 per diluted share, compared to $10.4 billion, or $0.98 per diluted share, in Q1 2024

- AWS

- AWS revenue rose 17% year-over-year to $29.3 billion

- AWS operating income was $11.5 billion, compared with $9.4 billion in Q1 2024

- AWS is on track for a $117 billion annualized revenue run rate

- Amazon is significantly increasing capital investment in AWS, with expenditures expected to exceed $100 billion in 2025. This investment focuses on global data center construction and custom chip R&D to support its leading position in cloud computing and AI.

- AWS operating income margin reached nearly 40% in Q1 2025

- Amazon’s advertising: Amazon’s advertising business delivered 19% year-over-year growth to $13.9 billion.

DGF is a diversified portfolio across multiple asset classes. This has helped the portfolio to perform well vs peers in periods of volatility as we are seeing currently. During the quarter, DGF added to its unlisted property development holdings via a further investment in Legacy Property, a strategic relationship that has performed well over time. This particular investment is in the ‘The Works’ – a development opportunity located in the northern suburbs of Wollongong.

Legacy Property Holdings – The Works – Stage 1

The Works is a well located and in-demand 775 apartment community adjacent to the Corrimal train station and a short walk to the beach in the Northern suburbs of Wollongong, Legacy Property rezoned the site from industrial to residential over 5.5 years, over the last year completed site wide demolition and civil works, secured DA approval from Council, agreed the construction contract price with Growthbuilt and recently sold the first 30 apartments. All in preparation to commence construction in 3 months. This stage 1 capital raise provides funding for land, design and construction costs to develop and sell 179 apartments. Investors are repaid principal and interest from proceeds of Stage 1 sales.

Terms

- 17% per annum, annually compoundin

- Principal is guaranteed by Legacy Property Holding

- 24-month term (upon conclusion, you can choose to redeem or roll your principal and interest into the next project stage which will be the subject of a new IM)

At DGF we like this investment because it is uncorrelated to equity markets, provides a high return, is principal guaranteed and we have a strong view of the under lying manager Legacy Property Holdings, a long term relationship of the DGF team.

As always, we are available for a more granular

conversation at any time.

Regards,

Key Information

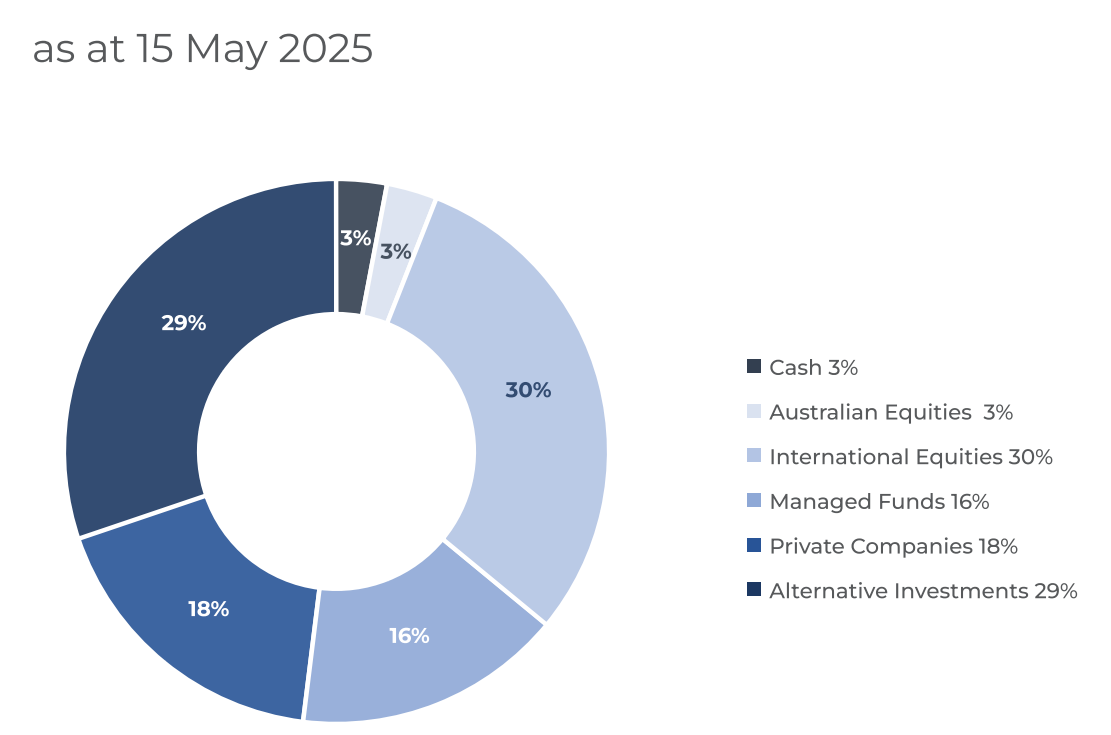

Sector allocation

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorised Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https://defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund

are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722). This information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.