Dear Investors,

The Defender Credit Fund (“DCF”) team continued to assess new loan opportunities, make new loans and manage the existing loan book over the quarter, including from time-to-time managing loans that are in default.

DCF has a rigorous process for loans that enter a default position. With careful monitoring of individual loans and the overall book, swift action ensures any default situations are adequately managed.

This approach is particularly important in the current macroeconomic environment in Australia, with cost-of-living pressure, interest rates on hold/trending down and property prices rising only modestly.

In the current macroeconomic environment, DCF is taking a cautious approach to new loans, targeting new loans with lower loan to value ratios, high quality security, and where possible a first mortgage position as lender.

This domestic economy is still however seeing a boom in the growth of private credit, with the Reserve Bank of Australia estimating in a Herbert Smith Freehills article titled ‘A pulse on Private Credit Investment in Australia’ estimating there is around $40 billion in private credit outstanding in Australia, equivalent to 2.5% of total business debt and growing.

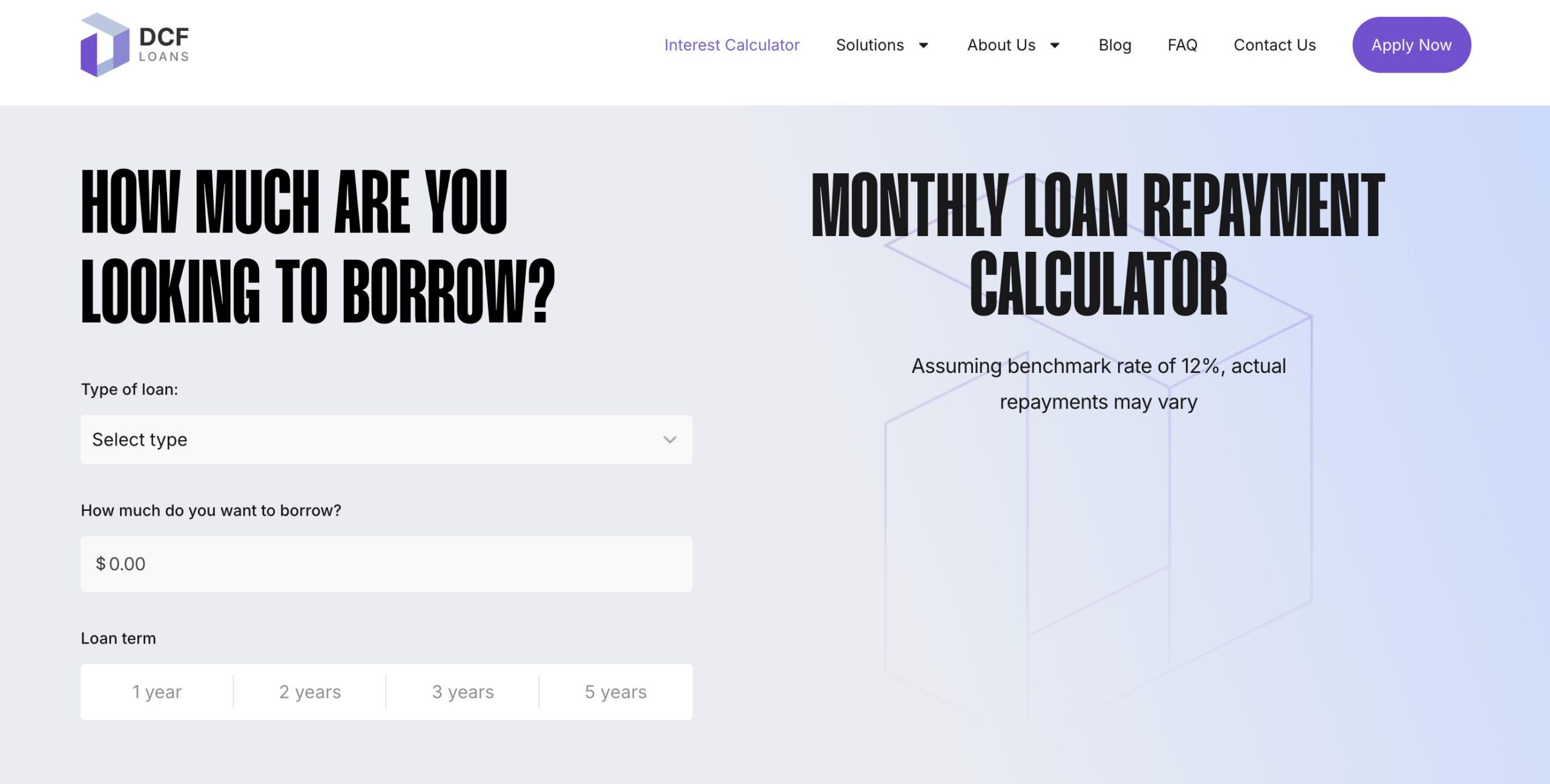

For more information on DCF and a useful borrowing calculator, please visit DCF Lending Pty Ltd website here.

Distributions for the period were made across our different class types:

- Class D – 15%pa, 14-month term (minimum investment $1.5M).

- Class E – 14%pa, 14-month term.

- Class F – 7%pa, 7-month term.

As always, we are available for a more granular conversation at any time.

Regards,

The Defender Credit Fund Team

More information on the Defender Credit Fund can be found at:

https://www.defenderam.com/