Investment objective

The investment objective is to generate superior returns for Unit holders by investing in global markets, with a focus on reducing risk and preserving capital.

More information can be found in the Information Memorandum located at the Fund website.

Applications available here.

Investment Strategy

The Defender Global Fund (Fund) provides investors with exposure to global markets through a long and short strategy

The Fund starts with the Managers global macroeconomic and market outlook, then overlays key thematics which the Manager believes will effect future performance and combines this with a bottom-up investment decision criteria.

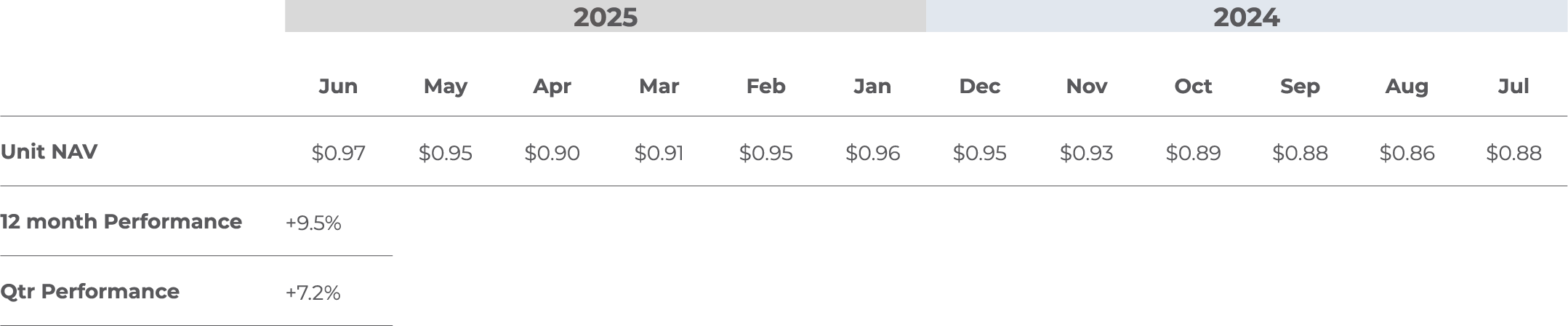

Performance Summary

Commentary

The Defender Global Fund returned +7.2% in Q2 CY2025.

The second quarter of 2025 witnessed a significant resurgence across global equity markets, characterized by a pronounced “risk-on” sentiment. This rebound was particularly evident in the United States, with major indices establishing new all-time highs. The rally was primarily propelled by robust corporate earnings, notably from large technology companies AMZN, GOOG, NVDA, MSFT, META, and increasing optimism surrounding potential fiscal policy adjustments, such as anticipated tax cuts.

These gains occurred despite lingering macroeconomic uncertainties, including persistent inflation concerns, ongoing trade tensions, and various geopolitical risks.

A notable aspect of the quarter was the divergence in global monetary policy. While some central banks, specifically the European Central Bank (ECB) and the Reserve Bank of Australia (RBA), initiated easing cycles, the U.S. Federal Reserve maintained a cautious “wait-and-see” stance.

The market s ability to rally strongly and maintain low implied volatility (VIX closing under 17) amidst significant external risks, such as inflation, trade disputes, and geopolitical conflicts, indicates a fundamental shift in investor priorities. This suggests that market participants were more focused on corporate fundamentals and potential policy catalysts, perceiving these headwinds as either manageable, temporary, or already factored into asset prices. The robust demand for equities, possibly driven by available liquidity and a search for returns in a disinflationary, but not recessionary, environment, underscores this resilience.

As written in our previous newsletter, after selling AMZN, GOOG and NVDA in Q4CY2024, these positions were bought back in Q1CY2025 during the tariff induced sell off. They have performed very well throughout Q2CY2025, along with other key international holdings MSFT, S&P500 and currency hedged NASDAQ positions.

DGF tracks multiple macroeconomic metrics to gauge the current and future direction of financial markets. In the second quarter of 2025, the US 10yr bond yield moved from 4.18% to 4.24%, the USD (measured by the Wall Street Journal Dollar Index) continued its inexorable slide from $99.69 to $93.91. Bitcoin moved from $82,389 to $108,356 and Gold moved from $3146/oz to $3350/oz.

US unemployment has remained stable around the 4.2% mark and inflation continues to moderate, albeit US tariffs as announced have cast doubt on the trajectory of these two economic variables due to trade policy uncertainty, which we expect will cause the Federal Reserve to cut interest rates twice in 2025 (which we expect will be supportive of markets in late 2025 and into 2026). Political pressure from President Trump also suggests interest rates will fall further in 2026, which is also supporting equity markets at present.

In summary, Q2CY2025 was a less volatile quarter relative to Q1CY2025, this has continued into Q3CY2025, with trade tensions moderating, equity markets rebounding to alltime highs at time of writing and sentiment vastly improved.

NVIDIA Q1CY2025 Earnings Result:

NVIDIA announced a record total revenue of $44.1 billion for Q1 FY26. This figure represents a staggering 69% increase year-over-year (YoY) from the $26.0 billion reported in Q1 FY25, and a robust 12% increase quarterover-quarter (QoQ) from the $39.3 billion in Q4 FY25. This performance significantly outpaced consensus analyst forecasts, which had anticipated revenue around $43.25 billion, signalling that even the most bullish market observers continue to underestimate the sheer velocity and magnitude of the demand for AI compute infrastructure.

The narrative of NVIDIAs recent success is overwhelmingly dominated by its Data Center business. In Q1 FY26, this segment achieved revenue of an astonishing $39.1 billion, marking a 73% increase YoY and a 10% increase QoQ. This single segment now constitutes approximately 89% of NVIDIAs total revenue, a figure that solidifies the company s complete transformation from its origins as a graphics card maker into the world s preeminent provider of AI infrastructure. The scale of this business is such that its quarterly revenue alone surpasses the annual revenue of many large technology corporations.

The primary driver of this quarter s exceptional performance was the successful and rapid production ramp of the new Blackwell architecture. In the earnings conference call, management described the Blackwell ramp as the “fastest in our company s history,” a significant statement given the complexity of the new platform. Remarkably, the Blackwell platform contributed nearly 70% of the Data Center compute revenue in its very first quarter of availability, indicating that customers are not just buying the new technology, but are transitioning from the previous-generation Hopper architecture with decisive speed. CEO Jensen Huang s declaration that the “breakthrough Blackwell NVL72 AI supercomputer… is now in full-scale production” confirms that NVIDIA has successfully navigated the immense supply chain and manufacturing challenges associated with launching such a sophisticated product.

This demand is fuelled by a fundamental shift in AI workloads. As management noted, AI workloads have “transitioned strongly to inference,” the process of using a trained model to make predictions or generate content. While model training is an intensive but often episodic task, inference can be a continuous, 24/7 workload, particularly for popular consumer-facing AI services. This structural shift from training to inference creates a sustained, baseline demand for compute that is driving the build-out of what NVIDIA terms “AI Factories.”

New Addition to Australian Listed Technology Portfolio ZIP CO LIMITED (ZIP.ASX)

During the second quarter, DGF initiated a position in ZIP CO LIMITED during the tariff induced sell-off. The position was acquired at $2.20/share, with the stock now trading at $3.02/share at time of writing.

Zip Co Limited (ASX: ZIP) is an Australian financial technology company primarily known for its “Buy Now, Pay Later” (BNPL) services. Founded in 2013, Zip aims to disrupt traditional credit models by offering consumers interest-free instalment payment options for purchases, both online and in-store. The company generates revenue primarily through transaction fees paid by merchants and, in some cases, late fees from customers.

Zip operates in two core markets: Australia & New Zealand (ANZ) and the United States (US), and also has a presence in Canada. Its main consumer products are Zip Pay and Zip Money, providing varying credit limits and repayment terms. Beyond consumer finance, Zip also offers unsecured loans and lines of credit to small and mediumsized businesses through its Zip Business segment.

The company has been actively working towards profitability and enhancing shareholder value, which has included initiatives like share buyback programs.

Recent Earnings and Updates Summary

Upgrade to FY25 Guidance:

- On June 11, 2025, Zip announced an upgrade to its FY25 guidance, projecting cash earnings before tax, depreciation, and amortization (EBTDA) of at least $160 million. This was a significant positive development for investors.

- This upgrade was largely driven by strong performance in the U.S. market, with Total Transaction Volume (TTV) growth exceeding 40% year-on-year in that region.

Strategic Share Buyback Program:

- Zip initiated a $50 million on-market share buyback program in April 2025, which has been ongoing with frequent updates. This demonstrates the company’s commitment to returning capital to shareholders and signals confidence in its financial position.

Given the rapid increase in share price over the quarter, DGF trimmed this position to make room for another global software technology company, Wisetech Global Limited (WTC.ASX), which we will write about more comprehensively in the next newsletter update.

As always, we are available for a more granular

conversation at any time.

Regards,

The Defender Global Fund Team.

Key Information

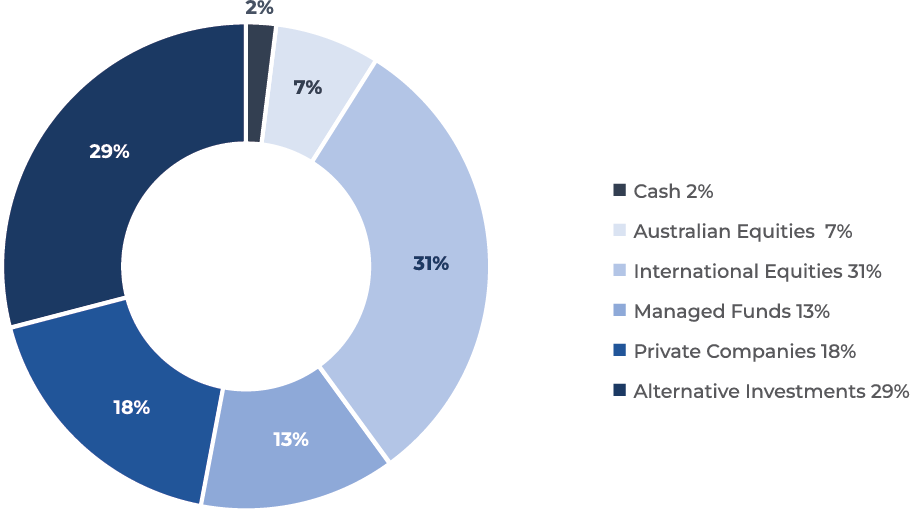

Sector allocation

Important Notice

This report has been prepared by Defender Capital Pty Ltd ABN 58 636 314 540, operating under a Corporate Authorised Representative agreement of Defender Asset Management Limited (AFSL 482722) (CAR 001 285 563), Fund Manager of the Defender Global Fund (ABN 27 482 997 023) without taking into account the objectives, financial situation or needs of individuals and is prepared only for wholesale investors. Before making an investment decision about the Fund, investors should read the Fund’s Information Memorandum available at the Funds website https:// defenderam.com/investments/ or by contacting [email protected] and obtain advice from an appropriate financial adviser. Units in the Fund are issued by Defender Asset Management Limited (ABN 29 608 281 189) (AFSL 482722).

his information is current as at the date of publication. The material has been prepared based on information believed to be accurate at the time of publication. Assumptions and estimates may have been made which may prove not to be accurate. Defender Capital undertakes no responsibility to correct any such inaccuracy. Subsequent changes in circumstances may occur at any time and may impact the accuracy of the information. To the full extent permitted by law, neither the Fund Manager, the trustee or any related entities makes any warranty as to the accuracy or completeness of the information in this newsletter and disclaims all liability that may arise due to any information contained in this newsletter being inaccurate, unreliable, or incomplete. Past performance is not a reliable indicator of future performance.